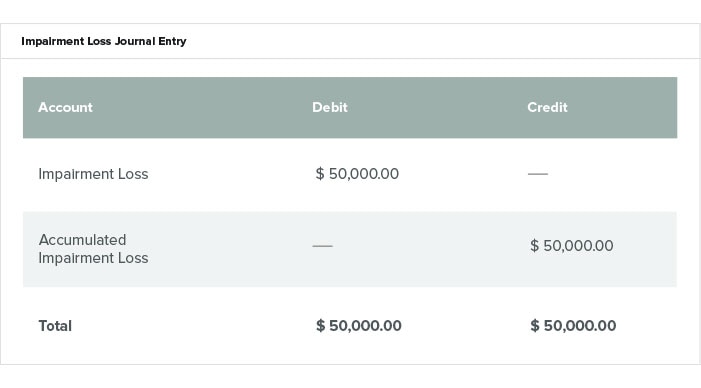

Impairment Loss Journal Entry

In case there is revaluation surplus journal entry will be as follows. To recognize impairment on accounts receivable Bad Debts Expense xx Account Receivable xx b.

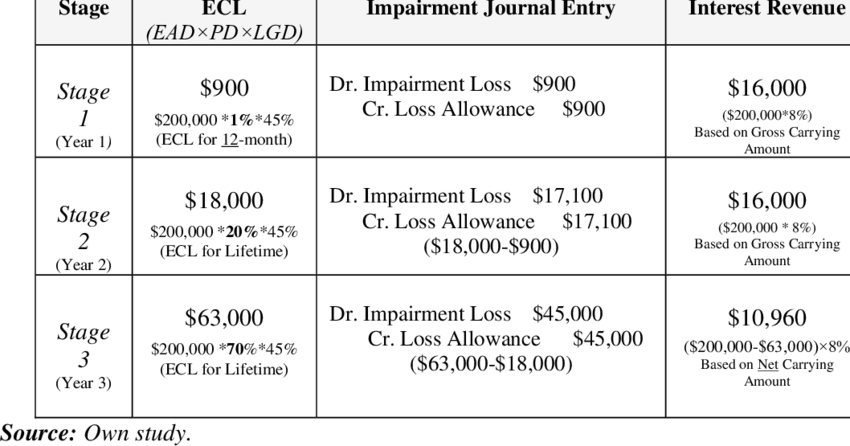

Accounting Treatment For Impairment Of Financial Assets Under Ifrs 9 Download High Quality Scientific Diagram

Impairment loss Dr OCI Impairment loss Dr PL Accumulated impairment loss Cr Following.

. The land cost 400000 two years ago. Determines the fair value of the plant to be 420000 in the market. Reversal of impairment loss.

The impairment loss is when the book value is higher than the fair value. Company ABC Limited has identified an impairment loss of 300000 on one of its land which will not be recovered shortly soon. The journal entry to record the impairment loss would be.

Therefore the company suspects the asset to have incurred an impairment loss. To record recovery of accounts Accounts Receivable xx Bad Debts. The journal entry for this is Keep in mind for disclosure purposes under IAS 16.

When allocating the impairment loss of 1m Entity A plans to allocate 04m to an obsolete production line which is still working but at a slower rate than other production. The total carrying value for the CGU is 2600000 and the total estimated recoverable amount is 1350000. The journal entries that are required to record these transactions are as follows.

The other side of the journal. As the result company needs to reduce the assets book value from the balance sheet. The company can make the journal entry for goodwill impairment by debiting the goodwill impairment account and crediting the goodwill account when it finds out that there is an.

In this case the company ABC needs to make the fixed asset impairment journal entry for the impairment loss of 50000 due to obsolescence of its machine as below. The journal entry would be. Instead youll credit an account called Accumulated depreciation and impairment losses.

Impairment loss Recoverable amount Carrying value Impairment loss 400000 500000 Impairment loss 100000 ABC Co. Here is an example of goodwill impairment and its impact on the balance sheet income statement and cash flow statement. An impairment loss is recognized and accrued through a journal entry to record and reevaluate the assets value.

The decrease in the fair value in this case is 20000 160000 140000 and as the balance of revaluation surplus is only 18000 in above example the excess amount of 2000 20000. Depn impairment losses 10. Company BB acquires the assets of company CC.

If due to any event the impaired asset regains. This loss will be as below. Recording an impairment loss for an individual asset -.

Then records the impairment. In this journal entry. Thus the total impairment loss amounts to 1250000.

In the journal entries above it can be seen that the loss on impairment of the asset is realized as an. Dr Impairment loss 10 Cr Accum. Learning Objectives Explain how to assess an asset for impairment Key.

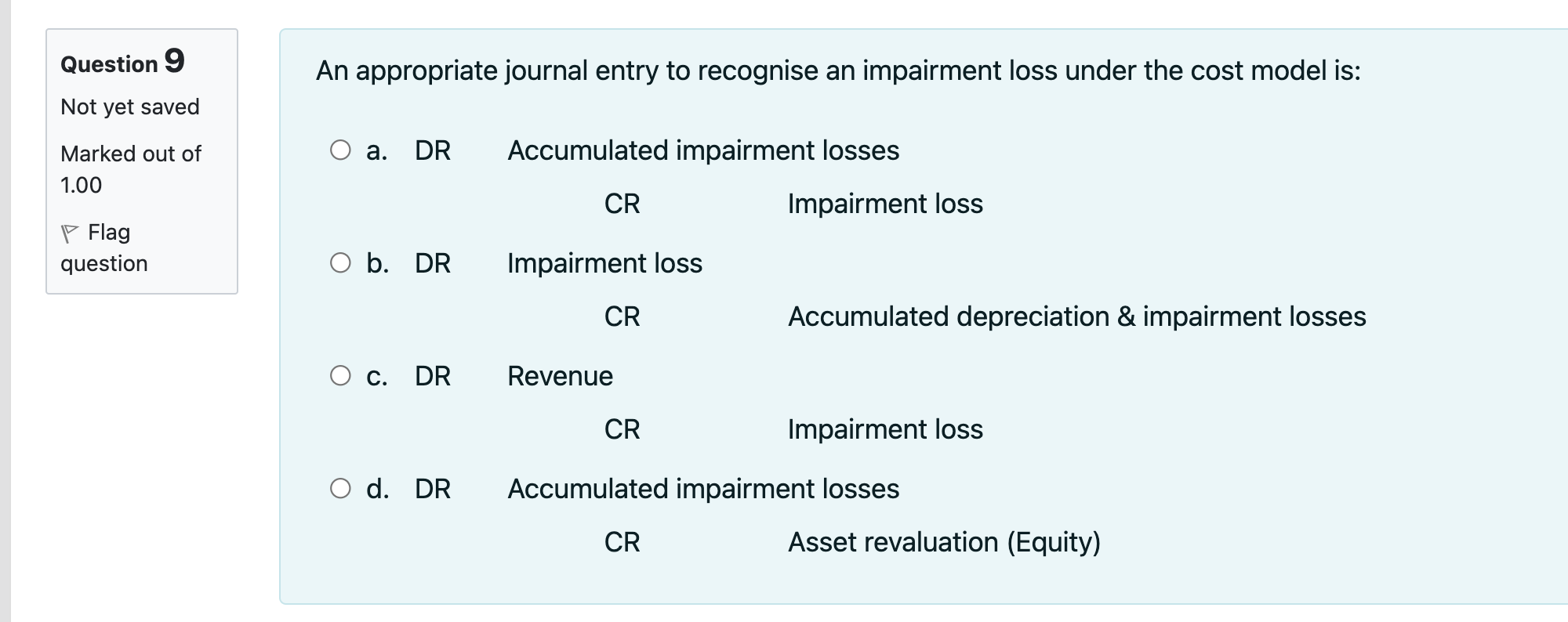

Solved Question 9 An Appropriate Journal Entry To Recognise Chegg Com

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

Fixed Asset Accounting Made Simple Netsuite

Impairment Loss Accounting Impairment Of Assets Held For Use Vs Intended For Disposal Youtube

0 Response to "Impairment Loss Journal Entry"

Post a Comment